China Trade Relations

China trade relations, particularly with the United States, are a crucial aspect of the global economy, characterized by a blend of economic interdependence and strategic competition. As of late 2025, bilateral trade between the two nations exceeds $650 billion annually, representing a significant portion of global trade activities. This complex relationship has been deeply impacted by numerous factors, including tariffs, technology restrictions, and ongoing geopolitical tensions. The U.S.–China trade war, a pivotal conflict that began in recent years, has led to the implementation of substantial tariffs on goods, affecting imports and exports on both sides. For instance, recent trade agreements have seen U.S. tariffs on Chinese goods reduced from 145% to 30%, while China has lowered its tariffs on U.S. imports from 125% to 10%. Despite these tensions, exports play a vital role in the economic stability and growth of both nations. Notably, while China exports high-tech items to the U.S., the U.S. continues to supply critical goods such as soybeans and aircraft. The evolving landscape of U.S.–China trade relations is additionally shaped by the ambition of China’s "Made in China 2025" initiative, aiming for leadership in high-tech sectors, and a shift in trade patterns emphasizing relations beyond Western markets. As trade dynamics continue to evolve, understanding the complexities of U.S.–China trade relations is essential for grasping their role in international economic discourse and the strategies both nations employ moving forward.

What are the concerns about China's growing influence in the Cook Islands?

The controversy in the Cook Islands highlights Western apprehension over China's expanding influence in the Pacific. Over the past three years, Beijing has signed numerous trade, financial, and security agreements across the region, directly challenging traditional Western allies' dominance in Oceania. Experts warn that the Cook Islands deal represents another strategic move in China's geopolitical agenda. Located between Hawaii and New Zealand in the South Pacific, the Cook Islands' partnership with China—which includes deep sea mining and economic cooperation—is viewed as part of a calculated effort that could potentially shift the balance of power in the Pacific region.

Watch clip answer (00:32m)How is Prime Minister Brown defending the controversial deal with China?

Prime Minister Brown defends the controversial agreement by highlighting the economic benefits, specifically citing a one-time $4 million grant from Beijing as a crucial financial boost for the Cook Islands. Despite this justification, there is growing opposition to the deal both domestically and internationally. Critics remain concerned that China's economic assistance could come with long-term strategic implications, potentially compromising the Cook Islands' autonomy and aligning with broader fears about China's expanding influence in the Pacific region.

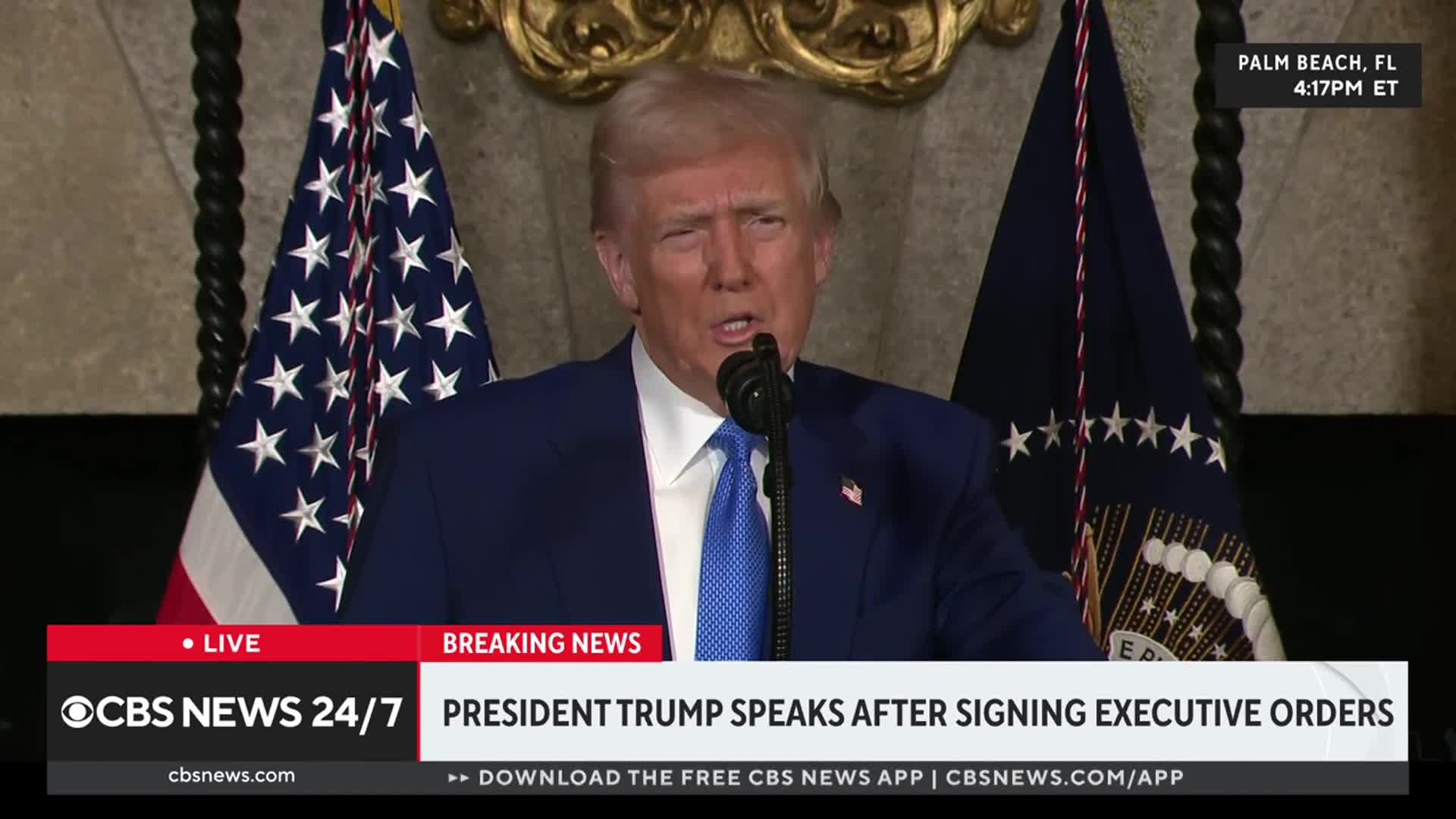

Watch clip answer (00:14m)What are the proposed tariff rates for autos, semiconductors, and pharmaceuticals?

President Trump indicates that the auto tariff rate will be around 25%, which he plans to officially announce on April 2. For semiconductors and pharmaceuticals, he states the tariffs will start at 25% and increase 'substantially higher over a course of a year.' Trump emphasizes that these tariffs will not apply to companies that manufacture within the United States. His policy aims to give foreign companies time to establish plants or factories in America, as he notes, 'when they come into the United States and they have their plant or factory here, there is no tariff.'

Watch clip answer (00:34m)How did Taiwan respond to Japan's decision to allow Taiwanese citizens to list Taiwan as their place of origin in family registries?

Taiwan's government warmly welcomed Japan's decision to allow Taiwanese citizens to list Taiwan instead of China as their place of origin in family registries. The Foreign Ministry spokesperson emphasized that this move demonstrates respect for the identity of Taiwanese residents living in Japan. This policy change is significant as it acknowledges the distinct regional identity of Taiwanese people, even though Japan officially regards Taiwan as a region rather than a sovereign country. The decision reinforces the close economic ties Japan has maintained with Taiwan, despite normalizing relations with Beijing in 1972.

Watch clip answer (00:13m)How have US and EU tariffs impacted Chinese electric vehicle exports?

Under the Biden administration, the US increased tariffs on Chinese EVs to 100%, while President Trump recently announced an additional 10% levy on Chinese goods. These actions create significant barriers for Chinese electric vehicle manufacturers seeking to enter the American market. Similarly, after investigating subsidization in China's automotive industry, the European Union imposed taxes of up to 35% on Chinese EVs. These combined trade measures from major Western economies represent substantial challenges for Chinese EV manufacturers like Zeekr, forcing them to reconsider their export strategies and potentially focus on alternative markets in regions like Australia and Southeast Asia.

Watch clip answer (00:24m)How have exports affected China's economy despite challenges?

Despite various challenges, exports have emerged as a bright spot for China's economy recently. This positive performance has been bolstered by a strategic approach of deliberately reducing dependence on the US Market. As Jessica Washington reports, this export-driven growth has allowed China to maintain economic momentum even as it faces trade tensions and tariffs, particularly in sectors like electric vehicles. By diversifying its international customer base and targeting markets in regions like Australia, Singapore, Malaysia, and the Middle East, China has created a more resilient export economy.

Watch clip answer (00:08m)