Banking

Banking is undergoing a significant transformation, driven by rapid technological advancements and evolving consumer expectations. In recent years, the rise of **digital-only banks**, often referred to as neobanks, has reshaped the financial landscape by offering **online banking** solutions that prioritize mobile-first experiences and lower fees. These institutions are particularly appealing to younger, tech-savvy customers, prompting traditional banks to enhance their digital offerings or collaborate with fintech firms to maintain competitiveness. The integration of **artificial intelligence (AI)** and automation is also critical, streamlining operations, improving customer service through AI-driven chatbots, and enhancing fraud detection. As the industry embraces these changes, the importance of essential financial products, such as **savings accounts** and various **business loans**, continues to grow. Recent trends indicate that loan growth is on the horizon, particularly as interest rates are expected to decrease, encouraging borrowing. Additionally, the push towards **sustainability** is becoming a focal point, aligning banking practices with broader societal goals. With the emergence of **embedded finance** and **banking-as-a-service** models, financial services are increasingly being integrated into daily life, further emphasizing the need for banks to adapt. Overall, the banking sector must leverage technological innovations and strategic partnerships to thrive amid the challenges of a continuously changing economic environment.

How would the merger between Capital One and Discover affect Capital One's position in the credit card industry?

The merger between Capital One and Discover would significantly elevate Capital One's market position, making it the largest credit card issuer in the United States. This strategic move would allow Capital One to surpass the current industry leader, JPMorgan Chase, representing a major shift in the competitive landscape of the credit card sector. The combined entity would benefit from increased scale and potential cost savings while enhancing consumer access to credit services. Additionally, by leveraging Discover's payment network, Capital One aims to compete more effectively against established payment networks like Visa and MasterCard.

Watch clip answer (00:05m)What would the merger between Capital One and Discover mean for the credit card industry and consumers?

For the credit card industry, the merger would create scale and cost efficiencies, allowing Capital One to better compete with giants like Visa and MasterCard. Capital One would leverage Discover's payment network infrastructure instead of paying for Visa/MasterCard's services, resulting in significant cost savings and synergies. For consumers, the merger promises improved access to locations with combined ATM networks from both companies. Customers could potentially see better financial offers, lower rates, and improved financing options as the merged entity would need to attract customers to compete with industry leaders. However, some analysts raise concerns about reduced competition, which is why regulatory approval has already faced delays.

Watch clip answer (02:00m)What were some of Kamala Harris's notable actions as California's Attorney General?

As California's Attorney General, Kamala Harris fought against the death penalty and took on big banks following the 2008 housing crisis, securing $18 billion in relief for California homeowners. She also won a billion dollars for victims of predatory for-profit universities, specifically Corinthian Colleges that took advantage of Californians seeking to achieve the American dream. Perhaps her most nationally recognized moment came when she directed the clerk of Los Angeles to begin issuing marriage licenses to same-sex couples during the contentious debate around Proposition 8, which challenged the legality of gay marriage. These actions demonstrated her commitment to criminal justice reform, consumer protection, and civil rights.

Watch clip answer (00:45m)What are investors concerned about in commodity markets?

Investors are demonstrating caution regarding the potential intensification of trade wars and their impact on commodity markets. The financial community appears to be monitoring signs of escalating trade tensions that could disrupt global commodity flows and pricing. This wariness comes amid a mixed market landscape where Asian shares show muted performance while European markets, particularly defense and banking sectors, reach new highs. Meanwhile, key commodities like Brent oil and gold are experiencing notable price fluctuations, reflecting the underlying uncertainty in global trade relations.

Watch clip answer (00:04m)How did customers react to the RBI's restrictions on New India Cooperative Bank?

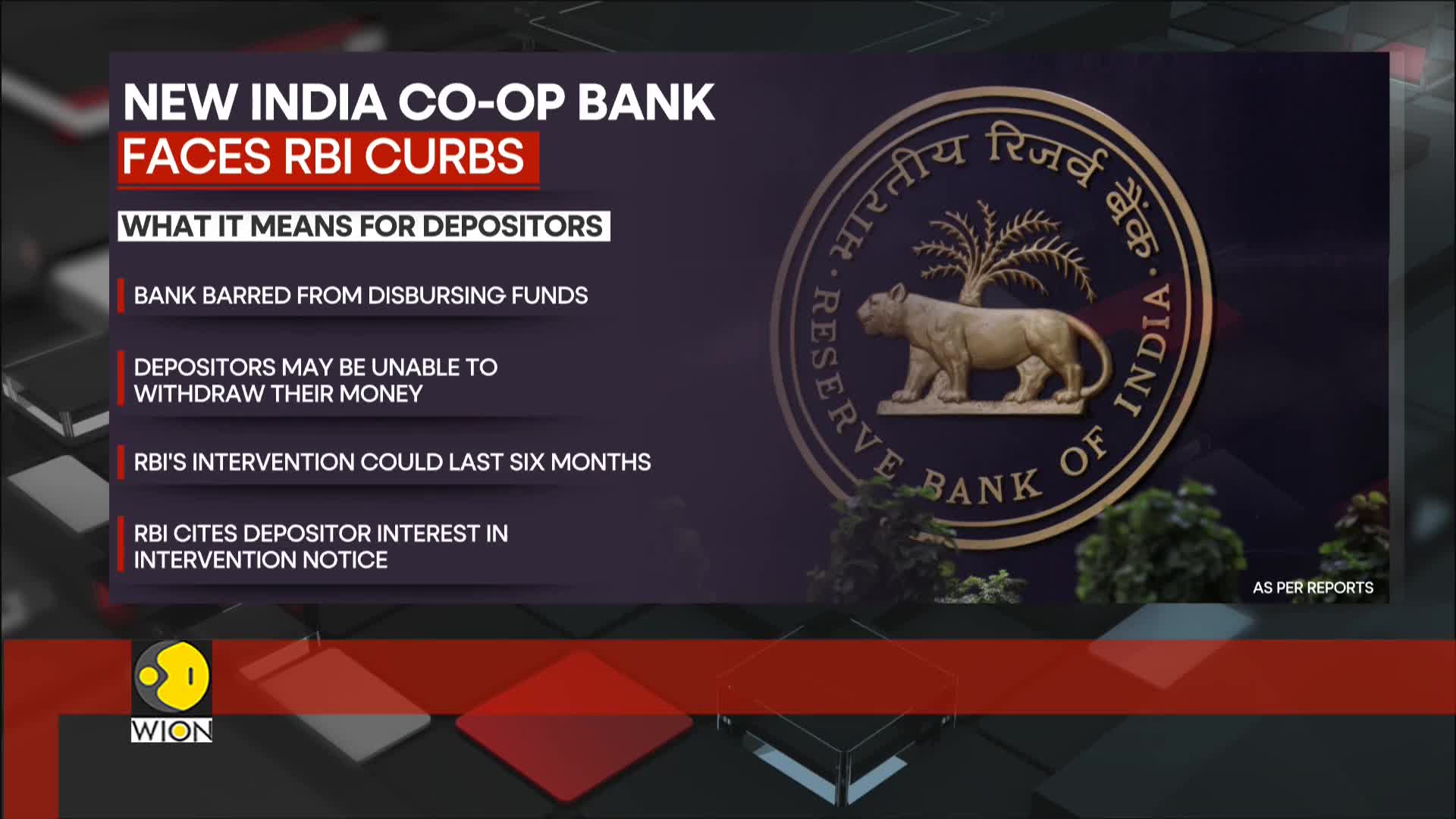

Following the announcement of restrictions by the Reserve Bank of India, customers rushed to New India Cooperative Bank's branches in panic, fearing their savings were at risk. Many depositors expressed frustration over the lack of prior warning about these limitations. The situation created immediate financial distress for customers who depend on regular access to their funds for monthly interest payments and daily expenses. This reaction highlights the vulnerability of depositors in smaller financial institutions when regulatory actions are implemented suddenly.

Watch clip answer (00:17m)What challenges are depositors facing due to the RBI restrictions on New India Cooperative Bank?

Depositors are experiencing significant financial distress due to the sudden RBI restrictions on New India Cooperative Bank. Many have expressed frustration over the lack of prior warning from the bank, leaving them unprepared for the fund disbursement limitations imposed for six months. With monthly interest payments and daily expenses to manage, customers face immediate financial hardship as they can't access their savings. The situation is particularly concerning because the bank's financial health has been under substantial pressure, yet depositors weren't adequately informed before the restrictions took effect.

Watch clip answer (00:15m)